What Not to Say to An Insurance Adjuster

April 11, 2022

You probably understand that what you say and don’t say in any situation usually affects the outcome. Rarely is this more valid than when speaking to an insurance adjuster following a car accident.

You probably understand that what you say and don’t say in any situation usually affects the outcome. Rarely is this more valid than when speaking to an insurance adjuster following a car accident.

Car crashes cause more accidental deaths in Georgia than anything else. Moreover, they are the second leading cause of emergency room visits and hospitalizations in the state. In many of them, those injured by negligent drivers rightly seek compensation from the at-fault driver’s insurance coverage. That driver’s insurance adjuster may be the first person who calls you after an accident, perhaps even before you get home from the hospital. The adjuster will sound concerned and tell you they want to help but beware.

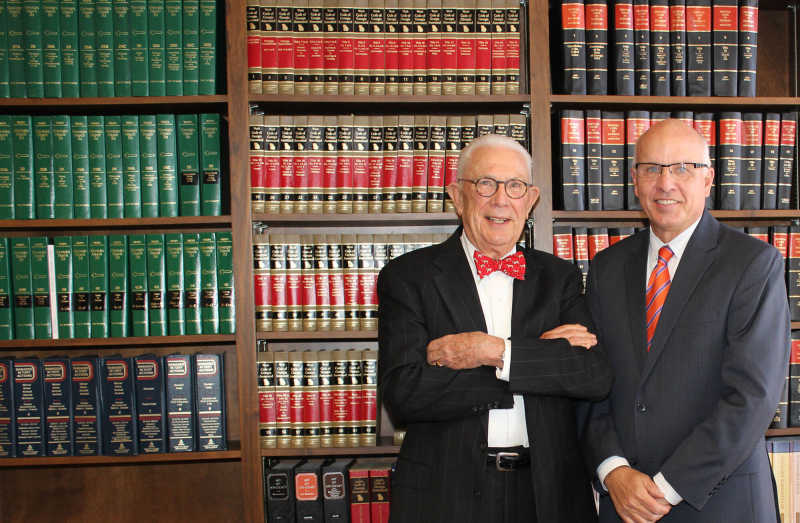

At Chambers & Aholt, LLC, we represent clients pursuing personal injury claims in Decatur, Georgia, and throughout Dekalb, Floyd, Gwinnett, Fulton, Clayton, Cobb, Polk, and Douglas counties. We think victims need to know what they should avoid saying to an insurance adjuster when pursuing a personal injury claim. We also think you should know why.

What Does an Insurance Adjuster Do?

The insurance adjuster handles your third-party liability claim against the company’s insured. The adjuster opens a claim, investigates the circumstances to determine fault, gathers information about your injuries and damages, and places a dollar value on your claim. The adjuster is motivated to keep the insurance company profitable by denying claims or paying injury victims as little as possible to settle them.

How Should I Handle a Request for a Statement?

It is vital to refuse to provide a statement and retain the services of an experienced personal injury lawyer to represent you. The adjuster will be looking for ways your answers can be used against you later to discount your injuries or attribute fault to you. Adjusters are trained to ask questions in ways that make your answers appear to contradict one another. That way, you appear to either be embellishing the truth or telling outright lies. In any case, the adjuster will use inconsistencies in your responses to reduce the value of your claim.

If you choose to provide a statement to the insurer without first consulting a personal injury lawyer, you should at least follow these recommendations:

Advise the adjuster that the conversation not be recorded. The adjuster should ask for your permission but even if they fail to do so, tell them they may not record the conversation. That forces the adjuster to have only their notes as evidence against you later.

Never, ever admit any guilt whatsoever. Even if you had looked down at the phone screen in your cup holder right before you were hit or were checking the rearview mirror, do not tell the adjuster. Georgia is an at-fault state which means the person most at fault is financially responsible for your damages. However, Georgia also observes modified comparative negligence, which means your settlement will be reduced by any percentage of fault assigned to you.

If you don’t know the answer to a question, say so. If your answer will include “I think” or “I suppose” or “I imagine” or anything similar, simply respond, “I don’t know.” Any suppositions beyond the actual facts you know will be used against you.

Don’t volunteer additional information. The adjuster will likely use long, silent pauses to entice you to volunteer more information than what they asked. That’s because long pauses can be uncomfortable, and most people are inclined to fill them. Remember, you aren’t chatting with a friend on this call. Rather, you’re being interrogated by the person who wants to pay you as little as possible or nothing at all.

Keep the exchange brief. If the question can be answered with a “yes,” “no,” or “I don’t know,” keep it to that. If you are asked the same question in a different way, which is another tactic the adjuster will use, advise them that you have answered that question already. At any point when the questions become redundant, tell the adjuster you are ending the call.

Never sign anything without consulting first with a personal injury attorney. If you have ever read your own auto insurance policy, you understand how vague, confusing, and highbrow the language is that is used by insurance companies. The same applies to any document they ask you to sign. They will count on you not fully understanding what you are agreeing to and will take full advantage of that fact.

What Information Will They Ask For?

The insurance adjuster will ask for basic information, such as your full name, address, telephone number, the name of your employer and what you do there, and contact information for your auto insurance company. This information is standard and benign, so it is fine to provide it.

The adjuster will then want to know what happened, what your injuries are, what treatment you have received, whether you can work or not due to your injuries, and other specific and frankly, protected information. Bearing in mind that the adjuster will use any information you provide against you when possible, details about your injuries and treatment are best handled by your attorney. The fact is that you may not even know the full extent and long-term prognosis of your injuries for weeks or months. Anything you tell the adjuster about your injuries or forget to tell them may severely damage your personal injury claim.

Additionally, the adjuster may ask you to sign a release so they may obtain copies of your medical records. Remember the preceding recommendation about not signing anything without having it first reviewed by your lawyer? You should heed that advice. There is a process for providing copies of your pertinent medical records to the insurance company at some point. After all, you will need evidence to support the value of your claim. As with the entire claims process, disclosures are better handled with your own attorney.

How Legal Counsel Can Help

Retaining us to represent you puts a layer of protection between you and the insurance company. Once we put the insurance adjuster on notice, all communication must go through us. Although direct communication is no longer allowed, you are nonetheless the one who makes all decisions regarding your case.

If you have been injured in a car accident, call Chambers & Aholt, LLC in Decatur, Georgia, to schedule a free case consultation. We can talk freely. We proudly serve clients in Dekalb, Floyd, Gwinnett, Fulton, Clayton, Cobb, Polk, and Douglas counties, Georgia.